What Is A Tax Deed Sale In Alabama . Property (ad valorem) taxes in alabama are due every october 1st through december 31st. understanding tax lien and tax deed. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. There are two types of tax sales in alabama. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. what is a tax sale? Finding tax delinquent properties in alabama. Any parcel with delinquent property tax will be auctioned off at a public sale annually. tax sales are the mechanism by which counties collect delinquent ad valorem taxes. The tax sale is held at. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help.

from cegvcogn.blob.core.windows.net

Property (ad valorem) taxes in alabama are due every october 1st through december 31st. understanding tax lien and tax deed. what is a tax sale? Finding tax delinquent properties in alabama. There are two types of tax sales in alabama. Any parcel with delinquent property tax will be auctioned off at a public sale annually. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. tax sales are the mechanism by which counties collect delinquent ad valorem taxes. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the.

Deed Search County Al at Philip Mims blog

What Is A Tax Deed Sale In Alabama The tax sale is held at. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. The tax sale is held at. There are two types of tax sales in alabama. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. Finding tax delinquent properties in alabama. understanding tax lien and tax deed. tax sales are the mechanism by which counties collect delinquent ad valorem taxes. Property (ad valorem) taxes in alabama are due every october 1st through december 31st. Any parcel with delinquent property tax will be auctioned off at a public sale annually. what is a tax sale?

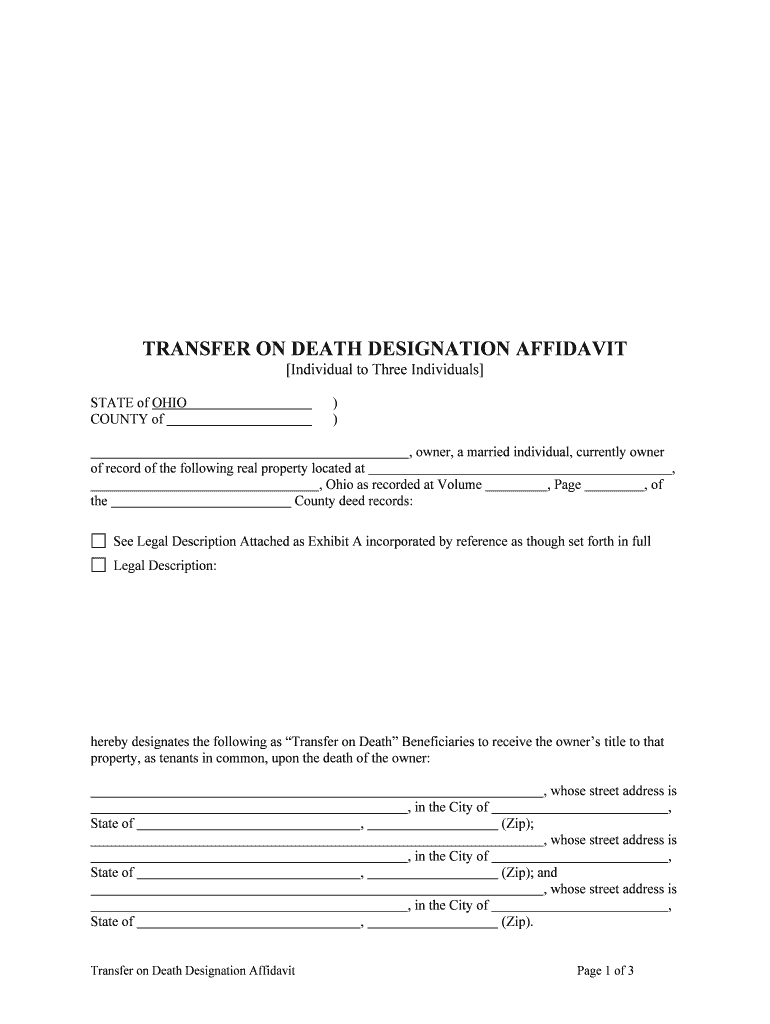

From www.uslegalforms.com

Alabama Agreement or Contract for Deed for Sale and Purchase of Real What Is A Tax Deed Sale In Alabama Property (ad valorem) taxes in alabama are due every october 1st through december 31st. Any parcel with delinquent property tax will be auctioned off at a public sale annually. Finding tax delinquent properties in alabama. what is a tax sale? sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs. What Is A Tax Deed Sale In Alabama.

From www.youtube.com

Alabama Tax Sales Everything you need to know YouTube What Is A Tax Deed Sale In Alabama tax sales are the mechanism by which counties collect delinquent ad valorem taxes. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs. What Is A Tax Deed Sale In Alabama.

From www.awesomefintech.com

Tax Deed AwesomeFinTech Blog What Is A Tax Deed Sale In Alabama tax sales are the mechanism by which counties collect delinquent ad valorem taxes. Property (ad valorem) taxes in alabama are due every october 1st through december 31st. Finding tax delinquent properties in alabama. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. . What Is A Tax Deed Sale In Alabama.

From esign.com

Free Alabama Deed of Trust Form PDF Word What Is A Tax Deed Sale In Alabama Property (ad valorem) taxes in alabama are due every october 1st through december 31st. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a. What Is A Tax Deed Sale In Alabama.

From www.templateroller.com

Form ADV LD3 Fill Out, Sign Online and Download Printable PDF What Is A Tax Deed Sale In Alabama if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. The tax sale is held at. understanding tax lien and tax deed. Property (ad valorem) taxes in alabama are due every october 1st through december 31st. what is a tax sale? Finding tax delinquent. What Is A Tax Deed Sale In Alabama.

From www.uslegalforms.com

Alabama Deed In Lieu of Foreclosure Deed In Lieu Of Foreclosure What Is A Tax Deed Sale In Alabama tax sales are the mechanism by which counties collect delinquent ad valorem taxes. The tax sale is held at. There are two types of tax sales in alabama. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. Finding tax delinquent properties in alabama. Any. What Is A Tax Deed Sale In Alabama.

From www.uslegalforms.com

Alabama Deeds Forms Package US Legal Forms What Is A Tax Deed Sale In Alabama understanding tax lien and tax deed. Finding tax delinquent properties in alabama. what is a tax sale? The tax sale is held at. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. tax sales are the mechanism by which counties collect delinquent. What Is A Tax Deed Sale In Alabama.

From www.templateroller.com

Alabama Gift Deed Form Fill Out, Sign Online and Download PDF What Is A Tax Deed Sale In Alabama Finding tax delinquent properties in alabama. Property (ad valorem) taxes in alabama are due every october 1st through december 31st. There are two types of tax sales in alabama. Any parcel with delinquent property tax will be auctioned off at a public sale annually. The tax sale is held at. what is a tax sale? if the state. What Is A Tax Deed Sale In Alabama.

From www.templateroller.com

Alabama Warranty Deed Form Fill Out, Sign Online and Download PDF What Is A Tax Deed Sale In Alabama if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. understanding tax lien and tax deed. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. Property (ad. What Is A Tax Deed Sale In Alabama.

From www.taxsaleresources.com

Tax Deed States with Real Life Case Studies Tax Sale Resources What Is A Tax Deed Sale In Alabama the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. what is a tax sale? sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. The tax. What Is A Tax Deed Sale In Alabama.

From taxfoundation.org

Updated State and Local Option Sales Tax What Is A Tax Deed Sale In Alabama understanding tax lien and tax deed. tax sales are the mechanism by which counties collect delinquent ad valorem taxes. Any parcel with delinquent property tax will be auctioned off at a public sale annually. The tax sale is held at. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a. What Is A Tax Deed Sale In Alabama.

From esign.com

Free Alabama Quit Claim Deed Form PDF Word What Is A Tax Deed Sale In Alabama the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. Finding tax delinquent properties in alabama. what. What Is A Tax Deed Sale In Alabama.

From www.attymarcelino.com

Deed of Absolute Sale Sample Template Free Download What Is A Tax Deed Sale In Alabama sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. if the state has held a tax sale certificate less than three years, the purchaser will be issued an assignment of the certificate. Property (ad valorem) taxes in alabama are due every october 1st. What Is A Tax Deed Sale In Alabama.

From www.scribd.com

Sample Deed of Sale PDF Land Lot Private Law What Is A Tax Deed Sale In Alabama understanding tax lien and tax deed. Finding tax delinquent properties in alabama. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. There are two types of tax sales in alabama. the alabama department of revenue recommends that anyone who buys a tax. What Is A Tax Deed Sale In Alabama.

From zamp.com

Ultimate Alabama Sales Tax Guide Zamp What Is A Tax Deed Sale In Alabama Finding tax delinquent properties in alabama. what is a tax sale? Any parcel with delinquent property tax will be auctioned off at a public sale annually. understanding tax lien and tax deed. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. There. What Is A Tax Deed Sale In Alabama.

From www.templateroller.com

Alabama Contract for Deed (Land Contract) Fill Out, Sign Online and What Is A Tax Deed Sale In Alabama There are two types of tax sales in alabama. tax sales are the mechanism by which counties collect delinquent ad valorem taxes. sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. the alabama department of revenue recommends that anyone who buys a. What Is A Tax Deed Sale In Alabama.

From www.dexform.com

Corporation form warranty deed (Alabama) in Word and Pdf formats What Is A Tax Deed Sale In Alabama sale amount is the accumulated delinquent tax (on the same basis as general property taxes), fees, and costs incurred in the sale to the. tax sales are the mechanism by which counties collect delinquent ad valorem taxes. understanding tax lien and tax deed. There are two types of tax sales in alabama. what is a tax. What Is A Tax Deed Sale In Alabama.

From esign.com

Free Alabama General Warranty Deed Form PDF Word What Is A Tax Deed Sale In Alabama Finding tax delinquent properties in alabama. The tax sale is held at. the alabama department of revenue recommends that anyone who buys a tax delinquent property and receives a tax deed hire a real estate lawyer to help. Property (ad valorem) taxes in alabama are due every october 1st through december 31st. if the state has held a. What Is A Tax Deed Sale In Alabama.